Oxford University researchers analysed crowd-sourced data from 1,600 US companies, revealing a correlation between workplace wellbeing and company profitability. A one-point increase in company happiness predicted a $2-3 billion increase in annual profit. The study also suggests that higher employee wellbeing predicts better stock market performance. A $1,000 portfolio equally weighted across the top 100 firms in the “Highest Wellbeing Places to Work” list, held from January 2021 – March 2023, generated ~$1,300, compared to ~$1,100 if they had invested in the S&P 500. While the data implies correlation, not causation, it emphasises the importance of prioritising employee wellbeing, not just for ethical reasons but also for the potential financial benefits.

You’ve probably come across the findings of a recent working paper from researchers at Oxford University, linking workplace wellbeing and firm performance. The results are encouraging and have been widely reported. Using organisation-level employee wellbeing measures based on crowd-sourced data from 1,600 companies in the United States, the researchers identified that wellbeing was associated with firm profitability and that companies with the highest levels of wellbeing also subsequently outperformed standard benchmarks in the stock market. However, I thought it might be helpful to look at how these findings were reached, so we can think about the strengths, limitations and how to apply and build on them.

How did the researchers measure wellbeing and performance?

Let’s begin by looking at how the researchers measured wellbeing. The data were gathered from Indeed, the jobs website. Since October 2019, Indeed has been collecting self-reported data on employee wellbeing. Using a survey, platform users have been invited to provide information about their wellbeing at the companies they currently or previously worked for.

The wellbeing survey includes four statements:

- I am happy at work most of the time.

- My work has a clear sense of purpose.

- Overall, I am completely satisfied with my job.

- I feel stressed at work most of the time.

Employees are asked to report the extent to which they agree or disagree with each statement on a 5-point scale from “strongly disagree” to “strongly agree.” In addition, the average of the four responses (with stress reverse-coded) is used to generate an overall ‘wellbeing score’.

Company performance was evaluated using Compustat’s North American Annual Fundamentals database data. The researchers look at several measures of company performance:

- The company’s value and how profitable it is. They used something called Tobin’s q to achieve this. It’s basically how much the company is worth in the market divided by what it would cost to replace all its assets, like its buildings and equipment. Think of it like a grade assigned by the stock market to describe the company’s future potential.

- Return on Assets (ROA). This is like a report card on how well a company uses what it has (its assets) to make money. The researchers calculate ROA by dividing the company’s net income (money it made after all costs and taxes) by the value of its assets.

- Annual gross profits.

What else was included in the analysis?

To conduct the analyses, the researchers looked at the company’s performance and its employees’ wellbeing in a particular year while taking into account other factors that might affect the results, such as how many data points were used to calculate the average wellbeing for the year, how many employees the company had, the value of its assets, and how much capital it employs. Also, to make sure they are comparing like with like, the researchers also accounted for the type of industry the company is in and the calendar year since things like economic conditions can change from year to year. Finally, they factored in statistical “wiggle room” to account for random differences between companies they may not have considered. Following this, they analysed how much the employees’ wellbeing was linked to the company’s performance.

What do the results mean for organisation performance in practical terms?

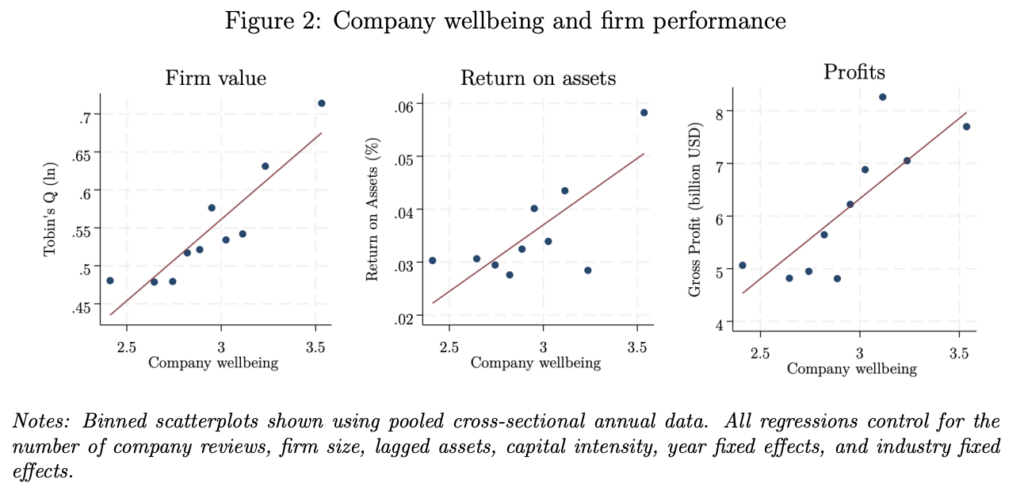

The researcher’s principal analysis was focused on average responses to the happiness item in the question, “I am happy at work most of the time”, as that was the most answered question. The team discovered that a one-point increase in company happiness (on a 1-5 scale) predicted a 1.7 percentage-point increase in ROA and a $2-3 billion USD increase in annual profit.

The wellbeing index also strongly predicted firm value, return on assets, and profits. However, it’s worth noting that responses to the stress question (“I feel stressed at work most of the time”) were less significantly related to performance than either happiness, satisfaction, or purpose.

Stress may help or harm performance

Perhaps unsurprisingly, stress was associated with worse organisational performance. However, the associations are only significant at the 10% level. Researchers typically consider results significant in most fields if the p-value is less than 5% (0.05) or sometimes even less than 1% (0.01). Consequently, while a result significant at the 10% level may suggest a trend or possible relationship, it is generally not strong enough evidence to conclusively state that there is an effect or relationship. This result could mean that stress affects companies both in good and bad ways, leading to greater uncertainty in the results. For example, where some stress can be beneficial—it might push employees to meet deadlines or solve tough problems, which can be good for the company; too much stress can lead to burnout and lower productivity, which isn’t great for the company. This interpretation is consistent with other studies in this area.

How did they evaluate the effect of wellbeing on stock market performance?

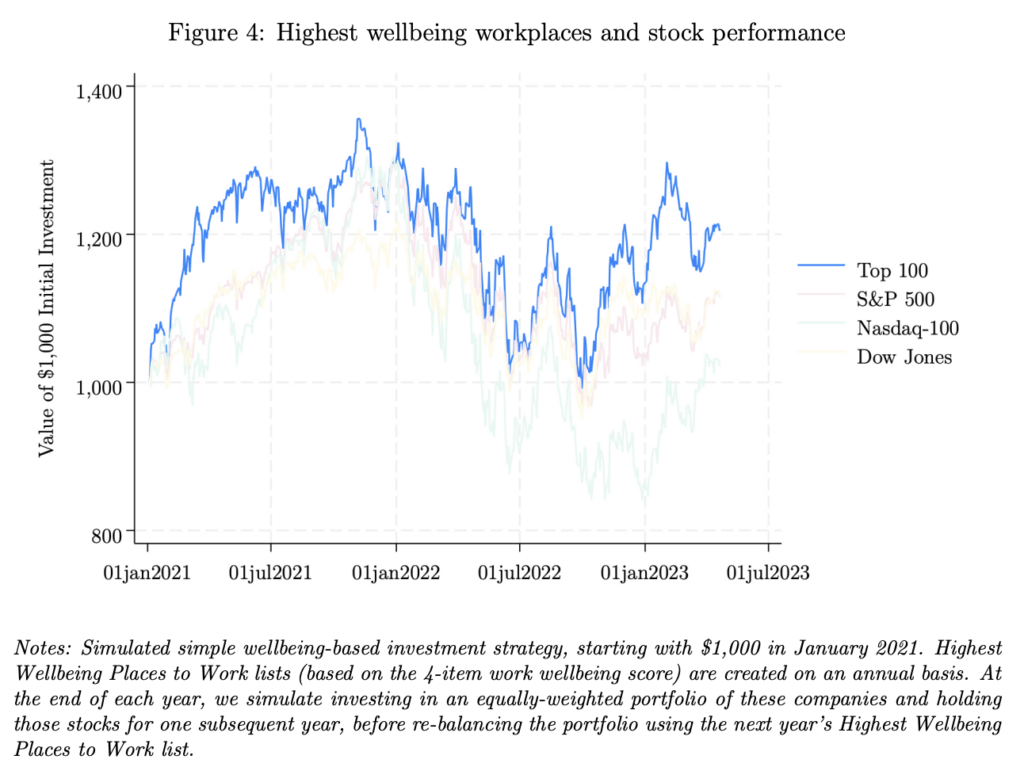

The researchers also constructed a hypothetical portfolio to evaluate whether better wellbeing predicted better company performance in the stock market. On the first trading day of 2021, the team made a theoretical investment, equally weighted across the top 100 firms from the 2020 “Highest Wellbeing Places to Work” list. They held these stocks until the final day of the trading year, then used the 2021 list to reinvest the money on the first trading day of 2022 in the new top 100 highest wellbeing companies.

They calculated the mean percentage return of the 100 stocks daily, using closing prices, then based returns on price changes, ignoring dividends and taxes to simplify things. As a benchmark, the researchers compared these stock returns to the S&P 500 index, the Nasdaq-100 and the Dow Industrial, which are widely recognised proxies for overall market performance.

The researchers found that investing $1,000 using this strategy in January 2021 would leave an investor with around $1,300 by the start of March 2023, compared with roughly $1,100 had they invested instead in the S&P 500.

What are the limitations?

Overall, the research indicates that companies prioritising employee wellbeing tend to be more successful. However, there are some caveats:

- The results imply correlation, not causation. Consequently, we can’t say for sure if employee wellbeing directly causes this success. Future research should look for natural experiments to understand these links better. For example, a policy change or a new program rolled out by some companies but not others can act as a natural experiment. This could provide a more concrete link between employee wellbeing initiatives and company success. For instance, if a government policy encourages companies to implement wellness programs, you can compare companies’ performance before and after the policy and between companies that adopted the program and those that didn’t.

- The data, sourced from Indeed, has limitations. It may be biased or unrepresentative. The study tried to control for this by only including current employees and a large number of reviews, but biases might still exist. Future studies could compare Indeed data to other wellbeing data, such as internal company surveys.

- The researchers note that they had to remove a lot of data for this study. This is because they needed to aggregate responses by company and only included companies with public financial records. Consequently, they are missing a lot of potential information.

- The predictive power of employee wellbeing relative to other measures of company culture could be investigated further. For example, factors such as leadership style, diversity and inclusion policies, team cohesion, openness to innovation, work-life balance, and more may also play a role.

- Lastly, this study only looked at US firms. It would be helpful to see if the findings hold in other countries and cultural contexts.

How can we apply the findings?

Here are a few ideas about how we could apply insights from this study in a practical context:

- Establish or Enhance Employee Wellbeing Programs: This first application is pretty obvious. The study emphasises the correlation between high employee wellbeing and better firm performance. In light of this, organisations should consider establishing or expanding initiatives to promote employee wellbeing. These initiatives could include mental health support, work-life balance policies, regular breaks, team-building activities, opportunities for personal growth and development, or wellness programs that promote physical health.

- Benchmarking and Continual Assessment: Organisations could adopt wellbeing measures as a part of their performance metrics. Regular surveys, employee feedback sessions, and other forms of data gathering could help companies monitor their progress and make adjustments as necessary. The data gathered could also help organisations identify stress points and areas for improvement in their work culture.

- Investment Decisions: The research shows that companies with high levels of employee wellbeing tend to outperform in the stock market. This could be used as a factor in making investment decisions. For example, investment funds or individual investors might choose to invest in companies that prioritise employee wellbeing, as they could be seen as having higher potential for profitability and success in the long term.

- Leadership and Management Training: It could be valuable to provide training for leaders and managers about the importance of promoting employee wellbeing and how it can be incorporated into their management strategies. This could involve training in areas such as emotional intelligence, compassionate leadership, and stress management techniques.

- Policy Advocacy: At a broader level, these findings could be used to advocate for policies prioritising employee wellbeing at the organisational and governmental levels. Companies could lobby for or support legislation that promotes employee wellbeing, such as laws regarding work hours, leave policies, and mental health support.

Conclusion

The research does a good job of highlighting the significant link between employee wellbeing and a company’s success. It challenges the conventional view that investing in wellbeing might hamper other organisational goals. Instead, the analyses of crowd-sourced data from Indeed show that higher employee wellbeing predicts better company performance – including greater firm value, higher return on assets, larger gross profits, and superior stock market performance. This underscores the need for organisations to prioritise wellbeing in the evolving work landscape. In essence, it’s not just ethically correct to look after employees’ wellbeing; it’s also beneficial for business.

Reference

De Neve, J-E., Kaats, M., Ward, G. (2023). Workplace Wellbeing and Firm Performance. University of Oxford Wellbeing Research Centre Working Paper 2304. doi.org/10.5287/ora-bpkbjayvk